Financial close is the culmination of the financial closing process, which reconciles, verifies, and finalizes all financial information related to a transaction or project. The goal of a financial close is to ensure that all financial information is accurate and consistent so that the parties involved can make informed decisions about the transaction or project.

Financial close management (FCM) ensures that the financial statements of a company are accurate and that the company is in compliance with all financial regulations. FCM is a critical process for publicly traded companies, as it is responsible for ensuring that the company’s books are in order and that it is meeting all of its financial obligations.

Find ways to streamline and automate the pre-close process.

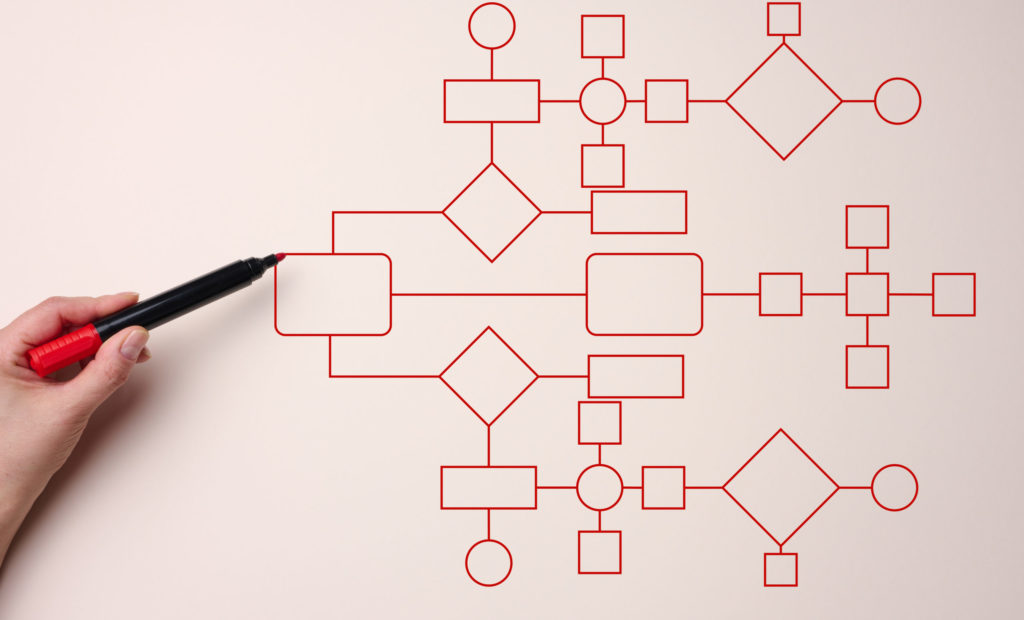

The pre-close process is an important part of the overall financial close process. The goal of the pre-close process is to get the company’s financial statements ready for review and approval by the company’s senior management and board of directors. The pre-close process typically includes the following steps:

The pre-close process can be streamlined and automated by using financial management software. Financial management software can automate the collection and review of financial data, the preparation of financial statements, and the approval of financial statements. Financial management software can also help companies improve their financial close process by providing insights and analysis into the company’s economic performance.

Use automation to streamline your financial close process.

Most business owners and CFOs would agree that automating the financial close process would save time and improve accuracy. Automating the process, however, can be easier said than done. The first step is to understand the different components of the financial close process and what tasks can be automated.

Most of these tasks that are typically included in the financial close process can be automated using accounting software or financial reporting tools. For example, account reconciliation can be automated using a tool that compares account balances in the accounting system to data from other sources, such as bank statements. Financial report generation can be automated using a tool that pulls data from the accounting system and formats it into the desired report.

The second step is to evaluate the various automation options and select the tools that best meet your needs. There are many factors to consider, such as the complexity of your financial close process, the number of users who will need access to the tools, and the level of automation required. Once the financial close process is automated, business owners and CFOs can focus on other important tasks, such as strategic planning and growth initiatives. Automating the financial close process can improve accuracy and efficiency, freeing up time to focus on other key business areas.

Assign tasks and due dates for each step in the process.

The financial close process is critical to a company’s success. It is the process by which a company reconciles its financial statements and prepares them for submission to its investors, lenders, and other stakeholders. However, the financial close process can be time-consuming and labor-intensive. To streamline and automate your company’s financial close process, you should establish procedures and protocols for the process.

The company’s financial close process can be streamlined and automated with the help of technology. By assigning specific tasks and due dates for each step in the process, you can ensure that the close is completed on time and without any glitches.

Streamlining and automating your company’s financial close process can save you time and money. By automating your financial close process, you can improve accuracy and efficiency while reducing the amount of time it takes to close your books.

You can streamline and automate your company’s financial close process by following these tips, making it faster and more efficient.